Sustainability

ESG Focus

Governance

Read the full report about CICT's Governance in our Sustainability Report 2024 here.

Framework

Risk Management

Corporate Governance

Business Ethics

- Maintain an appropriate level of independence and diversity of the Board guided by the Board Diversity Policy

- Commit to the highest standards of integrity in work and business dealings through the Ethics and Code of Business Conduct Policies

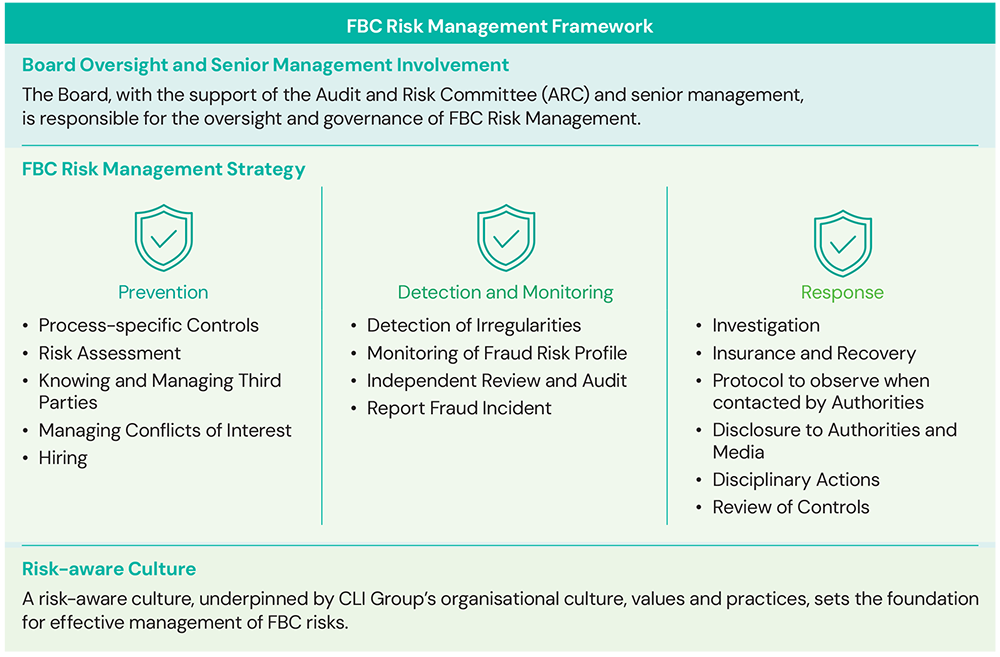

- Adopt a zero-tolerance stance against any Fraud, Bribery & Corruption (FBC) and manage these risks based on the FBC Risk Management Framework

- Adopt best practices and uphold corporate governance standards with reference to the Code of Corporate Governance 2018, and adhere to the highest standards of ethical conduct

- Diversity funding sources with sustainable financing

The Manager has a longstanding zero-tolerance stance against FBC in the conduct of its business activities and expects all its employees to be committed to the highest standards of integrity in their work and business dealings. The Manager's employees adhere to CLI's FBC Risk Management Policy which is published on CLI's intranet and is accessible by employees. The policy reiterates the strong stance against fraud, bribery and corruption and sets the overarching approach and standards for managing FBC risks in an integrated systematic and consistent manner. This stance is also reiterated during its regular staff communication sessions.

A whistleblowing policy and other procedures are put in place to provide the Manager’s employees and parties who have dealings with the Manager with well defined, accessible and trusted channels to report suspected fraud, corruption, dishonest practices or other improprieties in the workplace, and for the independent investigation of any reported incidents and appropriate follow up action. The objective of this policy is to encourage the reporting of such matters so that employees or external parties making any reports in good faith will be able to do so with the confidence that they will be treated fairly and, to the extent possible, be protected from reprisal. The Audit and Risk Committee (ARC) reviews all whistleblowing complaints at its scheduled meetings. Independent, thorough investigation and appropriate follow up actions are taken. The outcome of each investigation is reported to the ARC. All employees of the Manager are informed of this policy which is made available on CapitaLand Group’s intranet and on this website.

Click here to view the Whistleblowing Policy.

The Manager adheres to an ethics and code of business conduct policy which deals with issues such as confidentiality, conflict of interest, conduct and work discipline, corporate gifts and concessionary offers. Clear policies and guidelines on how to handle workplace harassment and grievances are also in place.

The policies and guidelines are published on CLI Group's intranet, which is accessible by all employees of the Manager. As part of their onboarding, employees are provided with training on such policies. The policies that the Manager has implemented aim to help detect and prevent fraud in mainly three ways, as set out below.

First, the Manager offers fair compensation packages, based on practices of pay-for-performance and promotion based on merit to its employees. The Manager also provides various healthcare subsidies and financial assistance schemes to alleviate the common financial pressures its employees may face.

Second, clearly documented policies and work procedures incorporate internal controls which ensure that adequate checks and balances are in place. Periodic audits are also conducted to evaluate the efficacy of these internal controls.

Finally, the Manager seeks to build and maintain the right organisational culture through its core values, educating its employees on good business conduct and ethical values.

As a holder of a Capital Markets Services Licence (CMSL) issued by MAS, the Manager abides by the MAS' guidelines on the prevention of money laundering and countering the financing of terrorism. Under these guidelines, the main obligations of the Manager are:

- evaluation of risk;

- customer due diligence;

- suspicious transaction reporting;

- record keeping;

- employee and CMSL Representative screening; and

- training.

The Manager has in place a policy on the prevention of money laundering and terrorism financing and remains alert at all times to suspicious transactions. Enhanced due diligence checks are performed on counterparties where there is a suspicion of money laundering or terrorism financing. Suspicious transactions will also be reported to the Suspicious Transaction Reporting Office of the Commercial Affairs Department.

Under this policy, all relevant records or documents relating to business relations with the CICT Group's customers or transactions entered into must be retained for a period of at least five years following the termination of such business relations or the completion of such transactions.

All prospective employees, officers and CMSL Representatives of the Manager are also screened against various money laundering and terrorism financing information sources and lists of designated entities and individuals provided by MAS. Periodic training is provided by the Manager to its Directors, employees and CMSL Representatives to ensure that they are updated and aware of applicable anti-money laundering and countering of terrorism financing regulations, the prevailing techniques and trends in money laundering and terrorism financing and the measures adopted by the Manager to combat money laundering and terrorism financing.

- Board of the Manager

- CEO of the Manager

- All staff

- Key performance indicators (KPIs) are linked to remuneration to all staff

- Abide by the FBC Risk Management Policy

- Annual Declaration through the "CLI Pledge" to uphold CapitaLand's core values, and not engage in any corrupt practices

- Participate in relevant training

- Abide by the FBC Risk Management Policy

- Endorse the Supply Chain Code of Conduct, and anti-corruption clause in key contracts