Corporate Governance

OUR GOVERNANCE FRAMEWORK

OUR ROLE

We, as the manager of CICT (Manager), set the strategic direction of CICT Group and make recommendations to HSBC Institutional Trust Services (Singapore) Limited, in its capacity as trustee of CICT (Trustee), on any investment or divestment opportunities for CICT and the enhancement of the assets of CICT in accordance with the stated investment strategy for CICT. The research, evaluation and analysis required for this purpose are coordinated and carried out by us as the Manager.

As the Manager, we have general powers of management over the assets of CICT. Our primary responsibility is to manage the assets and liabilities of CICT for the benefit of the Unitholders. We do this with a focus on generating rental income and enhancing asset value over time so as to maximise returns from the investments, and ultimately the distributions and total returns, to Unitholders.

Our other functions and responsibilities as the Manager include, but are not limited to:

- using our best endeavours to conduct CICT's business in a proper and efficient manner;

- preparing annual business plans for review by the directors of the Manager (Directors), including forecasts on revenue, net income, and capital expenditure, explanations on major variances to previous years' financial results, written commentaries on key issues and underlying assumptions on rental rates, operating expenses and any other relevant assumptions;

- ensuring compliance with relevant laws and regulations, including the Listing Manual of the Singapore Exchange Securities Trading Limited (SGX-ST) (Listing Manual), the Code on Collective Investment Schemes (CIS Code) issued by the Monetary Authority of Singapore (MAS) (including Appendix 6 of the CIS Code (Property Funds Appendix)), the Securities and Futures Act 2001 (SFA), written directions, notices, codes and other guidelines that the MAS may issue from time to time, the tax rulings issued by the Inland Revenue Authority of Singapore on the taxation of CICT and Unitholders and the United Kingdom's Alternative Investment Fund Managers Regulations 2013 (as amended) (AIFMR);

- attending to all regular communications with Unitholders; and

- supervising the property managers of CICT which perform the day-to-day property management functions (including leasing, marketing, promotion, operations coordination and other property management activities) for CICT's properties.

The Manager also considers sustainability issues (including environmental and social factors) as part of its responsibilities. More detailed information on the Board statement, sustainability frameworks, policies, practices and performances, climate-related disclosures, and stakeholder engagements are provided on CICT's website at www.cict.com.sg (Website) and in the Sustainability Report (SR) 2024 to be published in end-April 2025.

CICT, constituted as a trust, is externally managed by the Manager. The Manager appoints experienced and well-qualified personnel to run its day-to-day operations.

The Manager was appointed in accordance with the terms of the trust deed constituting CICT dated 29 October 2001 (as amended, varied or supplemented from time to time) (Trust Deed 1). The Trust Deed outlines certain circumstances under which the Manager can be removed, including by notice in writing given by the Trustee upon the occurrence of certain events, or by resolution passed by a simple majority of Unitholders present and voting at a meeting of Unitholders duly convened and held in accordance with the provisions of the Trust Deed.

The Manager is a wholly owned subsidiary of CLI which holds a significant unitholding interest in CICT. CLI is a leading global real asset manager, with a vested interest in the long-term performance of CICT. CLI's significant unitholding in CICT demonstrates its commitment to CICT and as a result, CLI's interest is aligned with that of other Unitholders. The Manager's association with CLI provides the following benefits, among other things, to CICT:

- strategic pipelines of property assets through, amongst others, CLI's access to the development capabilities of and pipeline investment opportunities from CapitaLand group's development arm;

- wider and better access to banking and capital markets on favourable terms;

- fund raising and treasury support; and

- access to a bench of experienced management talent.

OUR CORPORATE GOVERNANCE FRAMEWORK AND CULTURE

The Manager embraces the tenets of sound corporate governance, including accountability, transparency and sustainability. It is committed to enhancing longterm Unitholder value. The Board of Directors (Board) is responsible for setting the Manager's corporate governance standards and policies, which sets the tone at the top. This corporate governance report (Report) sets out the corporate governance practices for the financial year ended 31 December 2024 (FY 2024), benchmarked against the Code of Corporate Governance 2018 (Code).

Throughout FY 2024, the Manager has complied with the principles of corporate governance laid down by the Code and also, substantially, with the provisions underlying the principles of the Code. Where there are deviations from the provisions of the Code, appropriate explanations are provided in this Report. This Report also sets out additional policies and practices adopted by the Manager which are not provided in the Code. In FY 2024, CICT received multiple corporate governance, sustainability, and investor relations awards. Please refer to 2024 Highlights in Annual Report 2024 for more details.

BOARD MATTERS

Duties and Responsibilities

The Board's primary responsibility is to foster CICT's success so as to deliver sustainable value over the long term. It oversees the Manager's strategic direction, performance and affairs and provides guidance to the management team (Management), led by the CEO. The Board works with Management to achieve CICT's objectives and Management is accountable to the Board for its performance and the execution of CICT's strategy.

The Board establishes goals for Management and monitors the achievement of these goals. It ensures that proper and effective controls are in place to assess and manage business risks and compliance with the Listing Manual, Property Funds Appendix, and other applicable laws and regulations.

Written Board approval limits have been established, which are communicated to Management through the CLI Group's 2 intranet, setting out matters which require its approval, including written financial approval limits for capital expenditure, investments, divestments and bank borrowings. The Board delegates authority for transactions below those limits to Board Committees and Management for operational efficiency.

Directors are fiduciaries and are obliged at all times to act objectively in CICT's best interests. This sets the tone at the top on the desired organisational culture and ensures proper accountability within the Manager. The Board has adopted a Board Code of Business Conduct and Ethics which provides for every Director to adhere to the highest standards of ethical conduct and to avoid conflicts of interest. Each Director is required to disclose to the Board his/her interests in CICT's transactions (or potential transactions), and any other potential conflicts of interest, recuse himself/herself from deliberations and abstain from voting on such transactions. In FY 2024, every Director complied with this policy, and such compliance has been recorded in the minutes of meeting or written resolutions.

Directors' Development

The Nominating and Remuneration Committee (NRC) ensures that the Manager has a training framework to equip Directors with the necessary knowledge and skills to understand the CICT Group's business and discharge their duties and responsibilities as Directors (including their roles as executive, non-executive and IDs). Directors who have no prior experience as a director of an issuer listed on SGX-ST will undergo training on the roles and responsibilities of a director of a listed issuer as prescribed by the SGX-ST. The costs of training of all Directors are borne by the Manager.

Each newly appointed Director is provided with a letter of appointment and a Director's Manual (containing a broad range of information relating to Directors' roles and responsibilities and the Manager's policies on disclosure of interests in securities, conflicts of interests and securities trading restrictions). All Directors undergo an induction programme which focuses on orientating the Director to CICT's business, operations, policies, strategies, financial and governance practices, and includes visits to CICT's properties.

Directors are provided with opportunities for continuing education in areas such as director's duties and responsibilities, laws and regulations, risk management and accounting standards, industry related matters and sustainability (including sustainability training as prescribed under the Listing Manual) so as to be updated on matters that enhance their performance as Directors or Board Committee members. Directors can also request for training in any other area or recommend specific training and development programmes to the Board 3.

In FY 2024, the training and professional development programmes for the Directors included seminars and training sessions conducted by experts and senior business leaders on cyber security, ESG and sustainability.

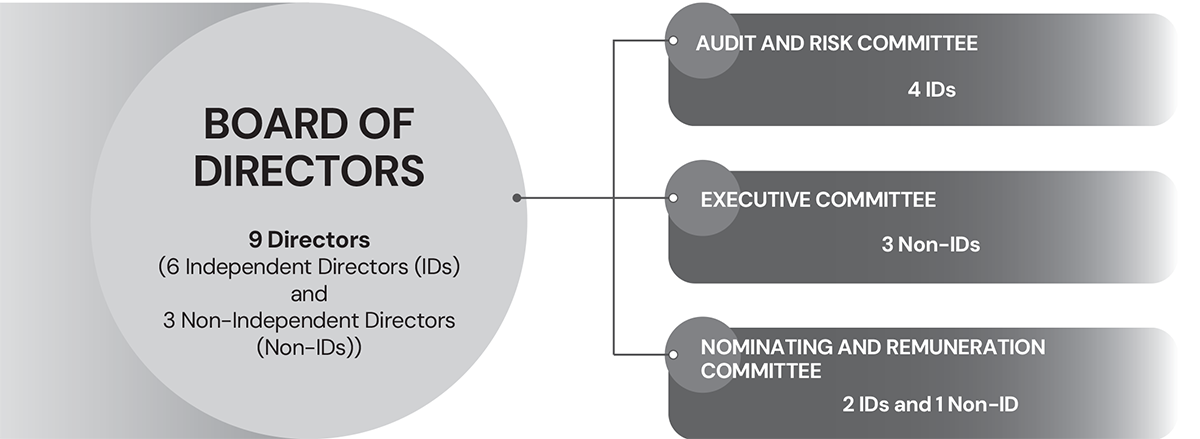

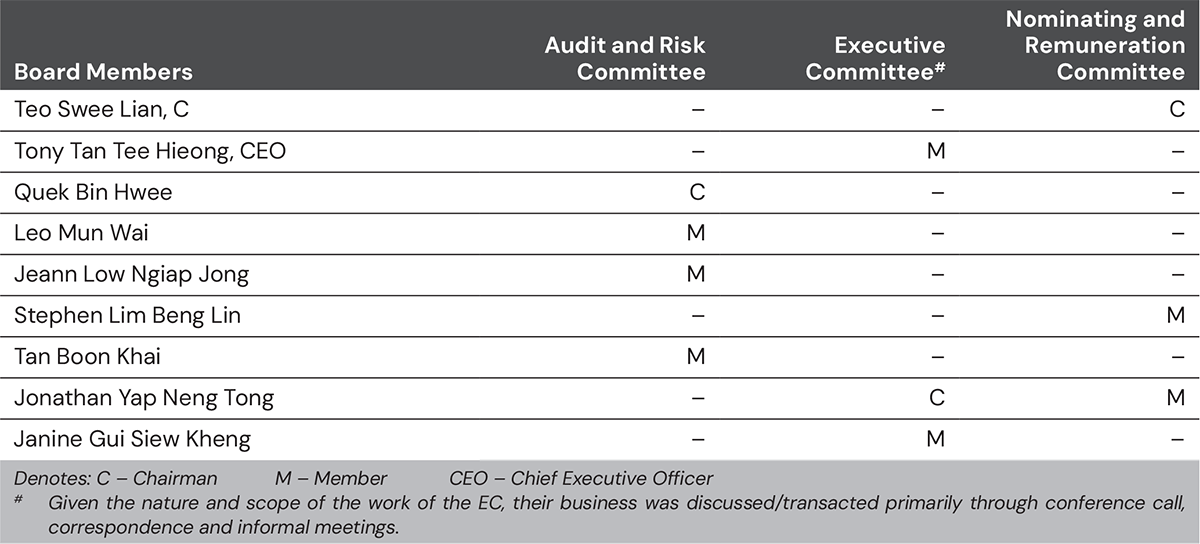

Board Committees

The Board has established various Board Committees to assist in the discharge of its functions. These Board Committees are the Audit and Risk Committee (ARC), the Executive Committee (EC) and the NRC.

Each Board Committee has clear written terms of reference (setting out its composition, authorities and duties, including reporting back to the Board) and operates under delegated authority from the Board with the Board retaining overall oversight. The decisions and significant matters discussed at Board Committees meetings are reported to the Board on a periodic basis, and minutes of such meetings are circulated to all Board members. The composition of the various Board Committees as at 28 February 2025 (being the latest practicable date prior to the issuance of this annual report) is set out in the table below.

Meetings of Board and Board Committees

Board and Board Committee meetings are scheduled prior to the start of each financial year. The Constitution of the Manager (Constitution) permits the Directors to participate via audio or video conference. The Board and Board Committees may also make decisions by way of written resolutions.

The Board may hold ad hoc meetings if required. The nonexecutive Directors, led by the independent Chairman, also meet at least twice a year without the presence of Management. The Chairman provides feedback to the Board and/or Management as appropriate.

There is active interaction between the Management and the Board, and Management provides updates to the Board at Board meetings on the progress of the CICT Group's business and operations (including market developments and trends, business initiatives, budget and capital management) and challenges CICT faces. The Directors and Management have separate, independent and unfettered access to each other at all times for any information they may require.

Management provides the Board with complete, adequate and timely information prior to Board and Board Committee meetings and on an ongoing basis to enable the Directors to make informed decisions, discharge their duties and responsibilities, and facilitate focused discussions and active participation.

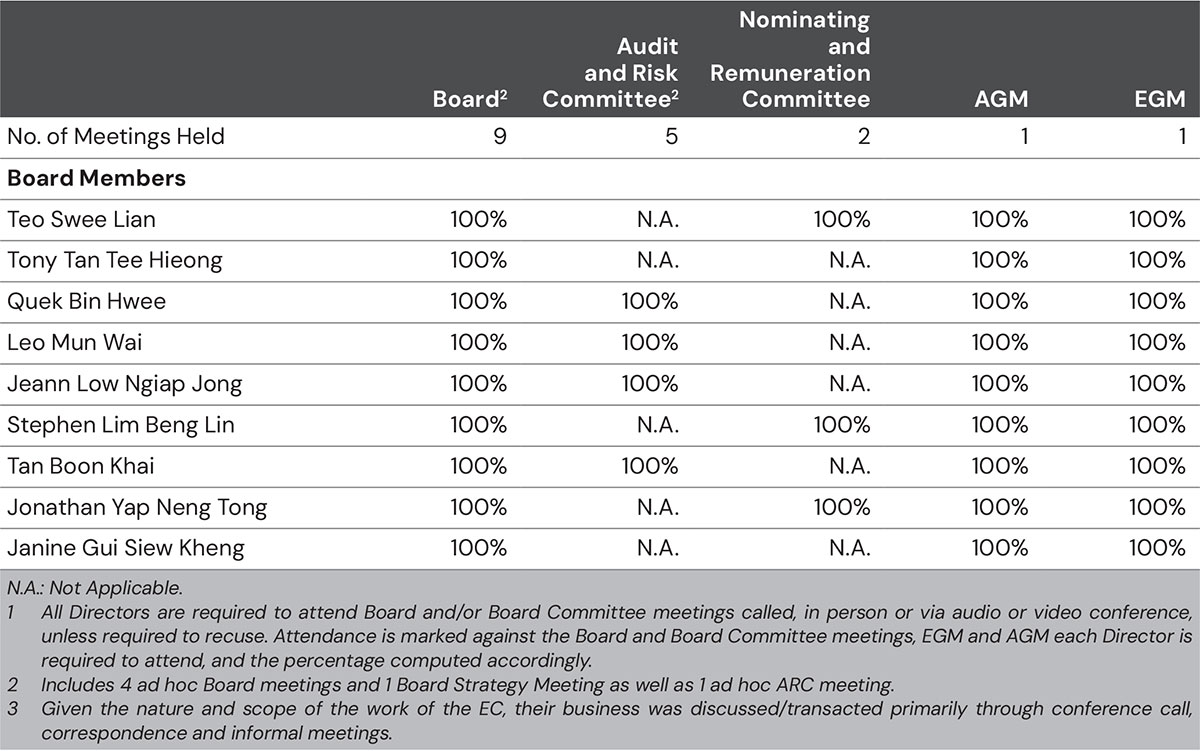

In FY 2024, the Board held nine meetings. The Directors' meeting attendance record for FY 2024 is set out on page 99 of annual report 2024. At Board and Board Committee meetings, all Directors actively participate in discussions, engaging in open and constructive debate and challenging Management on its assumptions and recommendations. No individual Director influences or dominates the decision-making process.

The Directors also have separate and independent access to the company secretary of the Manager (Company Secretary). The Company Secretary has oversight of corporate secretarial matters, ensuring that Board procedures are followed at Board meetings and facilitating the administration work relating to Directors' professional development. The appointment and the removal of the Company Secretary is subject to the Board's approval. The Directors are entitled to access to independent professional advice where required, at the Manager's expense.

Board Independence

The Board has a strong independent element as 6 out of 9 Directors, including the Chairman, are non-executive IDs. Other than the CEO, non-executive Directors make up the rest of the Board. None of the Directors have served on the Board for 9 years or longer. No lead ID is appointed as the Chairman is an ID. Profiles of the Directors and their roles are set out on the Board of Directors webpage.

The Board, through the NRC, reviews the size and composition of the Board and Board Committees regularly, to ensure that they are appropriate to support effective deliberations and decision-making, and the composition reflects a strong independent element and diversity of thought and background. The review takes into account the scope and nature of the CICT Group's operations, external environment and competition.

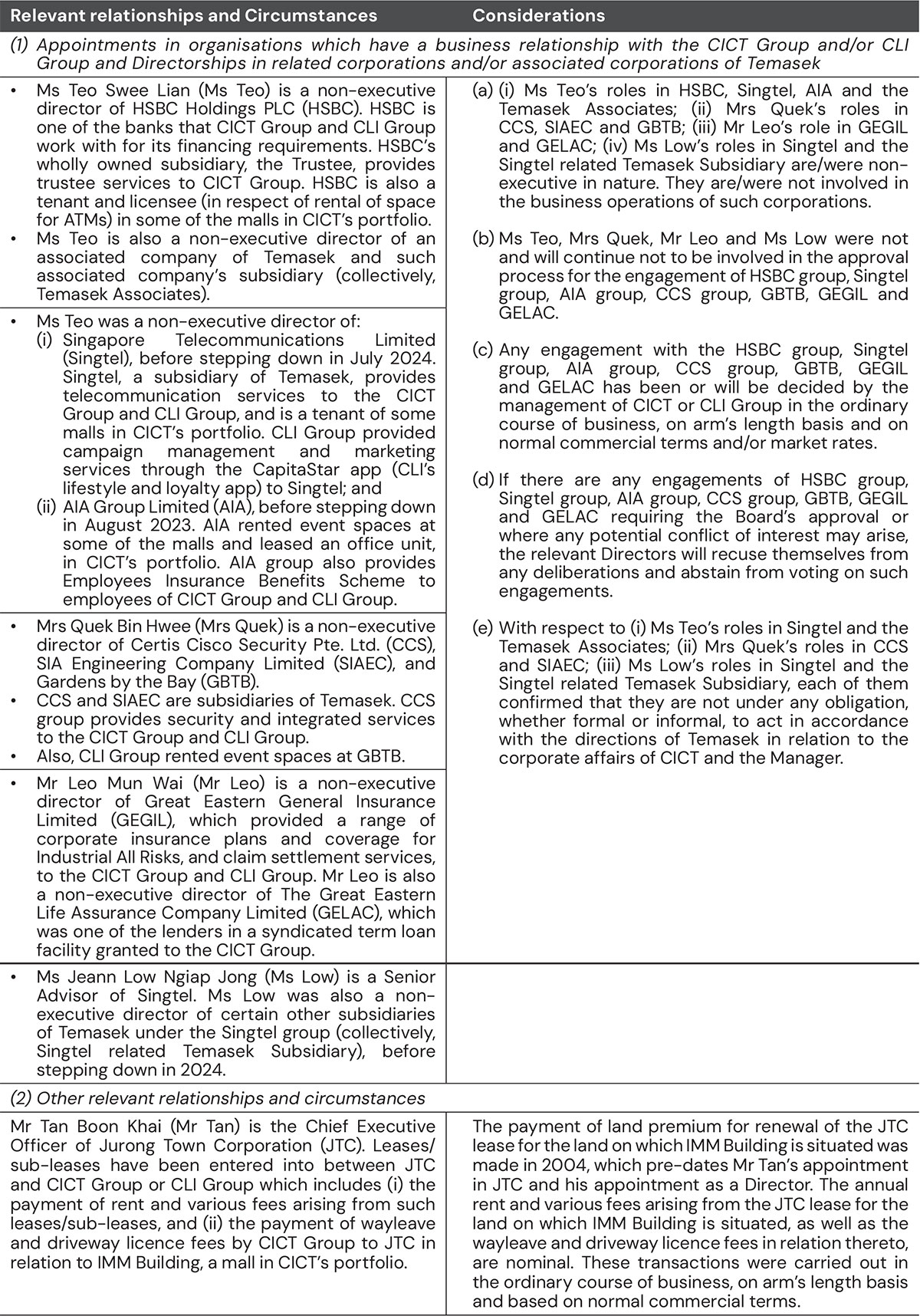

The Board, through the NRC, assesses annually (and when circumstances require) the independence of each Director in accordance with the requirements of the Listing Manual and the Code (including where relevant, the recommendations in the accompanying Practice Guidance (Practice Guidance)), and the Securities and Futures (Licensing and Conduct of Business) Regulations (SFR). Under the Code, a Director is considered independent if he/she is independent in conduct, character and judgement, has no relationship with the Manager, its related corporations, its substantial shareholders, CICT's substantial unitholders (being Unitholders who have interests in voting Units of 5% or more of the total votes attached to all voting Units) or the Manager's officers, that could interfere, or be reasonably perceived to interfere with the exercise of his/her independent business judgement in CICT's best interests 4.

There is a rigorous process to evaluate the independence of the Directors:

- each Director discloses his/her business interests and confirms annually that there are no relationships which interfere with the exercise of his/her independent business judgement in the Unitholders' best interests; such information is reviewed by the NRC; and

- the NRC considers the Directors' conduct and contributions at Board and Board Committee meetings, in particular, whether he/she has exercised independent business judgement in discharging his/her duties.

Thereafter, the NRC's recommendation is presented to the Board for its approval. Directors must recuse themselves from the NRC's and the Board's deliberations on their own independence. The NRC also reviews the independence of an ID when there is a change in their circumstances and makes recommendations to the Board. IDs are required to report to the Manager any changes which may affect their independence.

The outcome of the Board's assessment in February 2025 is set out below. In reviewing the Directors' independence, the NRC considered the relevant relationships and circumstances of each Director, including those specified in the Listing Manual, the SFR and the Code. These include: (a) appointments in organisations which have a business relationship with the CICT Group and/or the CLI Group, and (b) directorships in related corporations and/or associated corporations of Temasek Holdings (Private) Limited (Temasek), a substantial unitholder of CICT through its indirect interest in CLI. All Directors have recused themselves from the NRC's and the Board's deliberations on their own independence.

The Board has considered the conduct of each of Ms Teo, Mrs Quek, Mr Leo, Ms Low, and Mr Tan and is of the view that the relationships above did not interfere with the exercise of their independent judgement in the discharge of their duties and responsibilities as a Director. Mr Stephen Lim Beng Lin (Mr Lim) does not have any relationships and is not faced with any of the circumstances identified in the Code, SFR and Listing Manual, or other relationships which may affect his independent judgement. The Board is of the view that these Directors have exercised independent judgement in the discharge of their duties and responsibilities. The Board therefore determined that Ms Teo, Mrs Quek, Mr Leo, Ms Low, Mr Lim and Mr Tan are independent Directors.

The Board is of the view that as at the last day of FY 2024, Ms Teo, Mrs Quek, Mr Leo, Ms Low, Mr Lim, and Mr Tan were able to act in the Unitholders' best interests in respect of the period in which they served as Directors in FY 2024.

Based on the assessment, other than Mr Tony Tan Tee Hieong 5, Ms Janine Gui Siew Kheng 6 and Mr Jonathan Yap Neng Tong 7, all members of the Board are considered to be independent Directors.

Board Diversity

The Board embraces diversity and has a Board Diversity Policy which provides for the Board to comprise talented and dedicated Directors with a diverse mix of expertise, experience, perspectives, skills and backgrounds, with due consideration to diversity factors, including diversity in business or professional experience, age and gender.

The Board values the benefits that diversity can bring to the Board in its deliberations by enhancing decision-making capacity, avoiding groupthink and fostering constructive debate, which contributes to the effective governance of CICT's business and long-term sustainable growth.

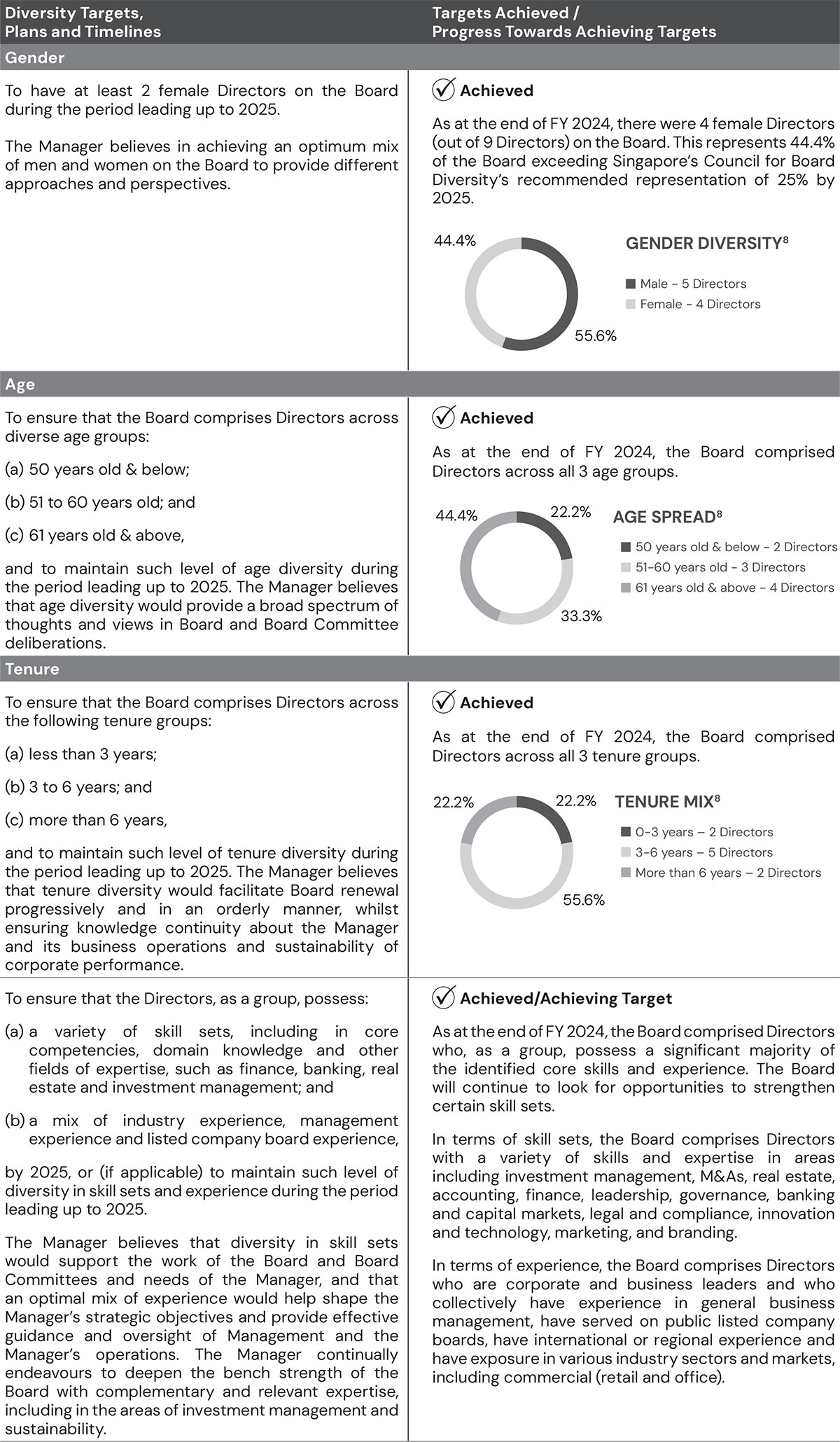

CICT's Board diversity targets, plans and timelines for achieving those targets are described below.

The charts above set out the key details relating to Board diversity, which is illustrative of how the Board has already achieved a level of diversity which fulfils the objectives as envisioned by the Board Diversity Policy - which is to leverage on the diversity in the Board in business and professional experience, age and gender to enhance the Board's decision-making capacity and ensure that the Manager has the opportunity to benefit from all available talent and perspectives.

The NRC has reviewed the size and composition of the Board and its committees and is of the opinion that the current size is appropriate with an appropriate balance and diversity of skills, knowledge, experience, gender, age and tenure, taking into account CICT's diversity targets, plans and timelines and objectives of the Board Diversity Policy and the CICT Group's business needs and plans, for effective decision-making and constructive debate.

The roles of the Chairman and the CEO are held by separate individuals to ensure a clear division of responsibilities between the leadership of the Board and Management, such that no individual has unfettered powers of decision-making. The Chairman does not share any family ties with the CEO.

The Chairman leads the Board and plays a pivotal role in promoting open and constructive engagement and dialogue among the Directors as well as between the Board and Management at meetings. The Chairman also presides at general meetings of Unitholders where she fosters constructive dialogue between the Unitholders, the Board and Management. The Chairman provides oversight to the CEO, who has full executive responsibilities to manage the CICT Group's business and to develop and implement Board-approved policies. The separation of the responsibilities of the Chairman and CEO and the resulting clarity of roles facilitate robust deliberations on the CICT Group's business activities and ensure an appropriate balance of power, increased accountability and greater capacity of the Board for independent decision-making.

As the roles of the Chairman and the CEO are held by separate individuals who are unrelated, and the Chairman is an ID, no lead ID has been appointed. Moreover, the Board has a strong independent element as 6 out of 9 Directors (including the Chairman) are non-executive IDs.

The Board has a formal and transparent process for the appointment and re-appointment of Directors, taking into account the need for progressive renewal of the Board. The NRC makes recommendations to the Board on all appointments to the Board and Board Committees. All Board appointments are made based on merit and subject to the Board's approval.

The NRC comprises 3 non-executive Directors, 2 of whom (including the chairman of the NRC) are IDs. The NRC met twice in FY 2024. Under its terms of reference, the NRC's scope of duties and responsibilities includes the following:

- review and make recommendations to the Board on the Board size and composition, succession plans for Directors and composition of the Board Committees;

- review and recommend an objective process and criteria for evaluation of performance of the Board, Board Committees and Directors;

- consider annually and when required, if a Director is independent; and

- consider and make recommendations to the Board on the appointment and re-appointment of Directors.

Guided by its terms of reference, the NRC oversees the development and succession planning for the CEO. This includes overseeing the process for selection of the CEO and conducting an annual review of career development and succession matters for the CEO 9.

Board Composition and Renewal

The NRC considers different time horizons for purposes of succession planning. The NRC evaluates the Board's competencies on a long-term basis and identifies competencies which may be further strengthened in the long term to achieve CICT's strategy and objectives. As part of medium-term planning, the NRC seeks to refresh the membership of the Board progressively and in an orderly manner, whilst ensuring continuity and sustainability of corporate performance. The NRC also considers contingency planning to prepare for sudden and unforeseen changes. In reviewing succession plans, the NRC has in mind CICT's strategic priorities and the factors affecting the long-term success of CICT. The NRC aims to maintain an optimal board composition by considering the trends affecting CICT, reviewing the skills needed and identifying gaps, including considering whether there is an appropriate level of diversity of thought. The process ensures that the Board has capabilities and experience which align with CICT's strategy and the operating environment, and includes the following considerations: (a) the current size of the Board and Board Committees, composition mix and core competencies, (b) the candidate's/ Director's independence, in the case of an ID, (c) the composition requirements for the Board and relevant Board Committees (if the candidate/Director is proposed to be appointed to any Board Committee), and (d) the candidate's/Director's age, gender, track record, experience and capabilities and such other relevant factors as may be determined by the Board, which would provide an appropriate balance and contribute to the collective skills of the Board.

The Board supports continuous renewal for good governance, and has guidelines which provide for IDs' tenure of no more than a maximum of two 3-year terms, with any extension of tenure beyond 6 years to be reviewed on a yearly basis up to a period of 9 years (inclusive of the initial two 3-year terms served) by the NRC. Board succession planning is part of the NRC's annual review of the Board's composition as well as when a Director gives notice of his/her intention to retire or resign. The annual review takes into account, among others, the requirements in the Listing Manual and the Code, feedback from any Board member and the diversity targets and factors in the Board Diversity Policy. The outcome is reported to the Board. The Board strives for orderly succession and continually looks to fill future gaps in competencies and to renew the Board in a progressive manner, whilst ensuring continuity and sustainability of corporate performance.

Searches for possible candidates are conducted through contacts and recommendations. External consultants may be retained to ensure a diverse slate of candidates. Candidates are identified based on CICT's needs, taking into account skills required and the requirements in the Listing Manual and the Code, and assessed against a range of criteria including their demonstrated business sense and judgement, skills and expertise, and market and industry knowledge (and may include financial, sustainability or other competency, geographical representation and business background) with due consideration to diversity factors in the Board Diversity Policy. The NRC also considers the candidate's alignment with CICT's strategic directions and values, ability to commit time and potential to complement the expertise and experience of existing Board members, as well as any qualitative feedback from Directors and Management from its annual Board evaluation exercise. The NRC uses a skills matrix to determine the skills gaps of the Board and if the expertise and experience of a candidate would complement those of the existing Board members.

Review of Directors' Ability to Commit Time

Directors must be able to devote sufficient time and attention to adequately perform their duties. Directors are required to report to the Board any changes in their other appointments or commitments.

For the Directors' other appointments and commitments, no limit is set as to the number of listed company board appointments. The Board takes the view that the number of listed company directorships that an individual may hold should be considered on a case-by-case basis, as a person's available time and attention may depend on factors, such as his/her capacity, employment status, and the nature of his/her other responsibilities. IDs are required to inform the Chairman before accepting any new directorships or offer of full time executive appointments.

Each Director is required to make a self-assessment and confirm that he/she is able to devote sufficient time and attention to the affairs of the Manager. For FY 2024, all non-executive Directors had undergone the self-assessment and provided such confirmation.

In assessing each Director's ability to commit time, the NRC takes into consideration each Director's confirmation, his/her other appointments and commitments, as well as attendance and conduct at Board and Board Committee meetings. The Directors' listed company directorships and other principal commitments are disclosed on the Board of Directors webpage. There is no alternate director to any of the Directors, which is in line with the principle adopted by the NRC that it will generally not approve the appointment of alternate directors.

Directors are informed of the expectation to attend scheduled meetings, unless unusual circumstances make attendance impractical or if a Director has to recuse himself/herself from the discussion. For FY 2024, the Directors achieved full attendance rates for Board and Board Committee meetings.

Based on the above, the NRC (with each member recused from deliberations in respect of himself/ herself) has determined that each Director has been adequately carrying out his/her duties as a Director and noted that no Director has a significant number of listed directorships and principal commitments. The Board, taking into consideration the NRC's assessment, has noted that each Director has been adequately carrying out his/her duties and responsibilities as a director of the Manager.

The Manager believes that regular self-assessment and evaluation of Board performance enables the Board to reflect on its effectiveness, including the quality of its decisions, and for Directors to consider their performance and contributions. The process helps identify key strengths and areas for improvement which are essential to effective stewardship of CICT.

The NRC recommends for the Board's approval the process and objective performance criteria, and the Board undertakes an annual evaluation of the effectiveness of the Board, Board Committees and individual Directors. As part of the process, a questionnaire is sent to the Directors. Management also provides feedback on areas including Board structure, strategy, performance and governance, as well as Board functions and practices. The results are aggregated and reported to the NRC, and thereafter the Board. The findings are considered by the Board and follow up action is taken where necessary. No external facilitators were appointed to assist in the evaluation process of the Board and Board committees.

Board and Board Committees

The evaluation categories covered in the questionnaire include Board composition, Board processes, strategy, performance and governance, access to information and Board Committee effectiveness. The Board also considers whether the creation of value for Unitholders has been taken into account in the decision-making process. For FY 2024, the outcome of the evaluation was satisfactory and the Board as a whole, and each of the Board Committees, received affirmative ratings across all the evaluation categories.

Individual Directors

The evaluation categories covered in the questionnaire include Director's duties, contributions, conduct and interpersonal skills, as well as strategic thinking and risk management. For FY 2024, the outcome of the evaluation was satisfactory and each Director received affirmative ratings across all the evaluation categories.

The Board believes that performance evaluation should be an ongoing process and seeks feedback on a regular basis. The regular interactions between the Directors, and between the Directors and Management, also contribute to this ongoing process. Through such engagement, the Board benefits from an understanding of shared norms between Directors which contributes to a positive Board culture.

REMUNERATION MATTERS

All fees and remuneration payable to Directors, key management personnel (including the CEO) and staff of the Manager are paid by the Manager.

The Board, assisted by the NRC, has a formal and transparent procedure for developing policies on Director and executive remuneration, recommending the individual Directors' remuneration packages to the Board for shareholders' approval, as well as determining the remuneration of key management personnel (KMP).

All NRC members are non-executive Directors, the majority of whom (including the NRC chairman) are independent Directors. Under the NRC's terms of reference, its key responsibilities are:

- To oversee the Manager's leadership development and succession planning for the CEO. The NRC oversees the process for selection of the CEO and reviews annually the career development and succession matters for the CEO. The Manager is committed to developing a strong talent pipeline to sustain its business growth, leveraging on CLI's established talent identification and succession processes. The NRC decides on the appointment of the CEO; and

- To review and recommend to the Board, remuneration frameworks for the Board and KMP; including reviewing the specific remuneration packages for each Director as well as for the KMP; and the administration of the Manager's Unit Plans. The Board sets the remuneration policies to support the CICT Group's business strategy and deliver sustainable returns to Unitholders. In its deliberations, the NRC also takes into consideration industry practices and norms in compensation to ensure market competitiveness.

The NRC considers all aspects of remuneration, including termination terms, to ensure they are fair, and has access to remuneration consultants for advice on remuneration matters as required. It approves the specific remuneration package for each KMP (including the CEO), and recommends to the Board for endorsement on the specific remuneration package for each Director.

While Provision 6.1 of the Code provides for the NRC to make recommendations to the Board on such matters, the Board is of the view that such matters are best reviewed and determined by the NRC as part of its focused scope and has delegated the decision-making on such matters to the NRC. The NRC reports any decisions made on such matters to the Board. This is accordingly consistent with the intent of Principle 6 of the Code.

In FY 2024, the NRC appointed an independent remuneration consultant, Willis Towers Watson (WTW), to provide professional advice on Board and executive remuneration. The appointed independent remuneration consultant advises the NRC on the compensation of the KMPs including, but not limited to, the reasonableness of compensation levels in relation to the performance achieved, the competitiveness of compensation levels against relevant industry peers, compensation trends and practices around the world. The consultant is not related to the Manager or any Directors, its controlling shareholder or its directors or CLI's related corporations.

Remuneration Policy and Framework

The remuneration policy and framework, which takes reference from the compensation framework of CLI, is designed to support the implementation of the CICT Group's business strategy and deliver sustainable returns to Unitholders.

The Manager is a subsidiary of CLI which also holds a significant stake in CICT. This association facilitates the Manager in attracting and retaining better qualified management talent. It further provides an intangible benefit to the employees of the Manager by offering the depth and breadth of experience associated with an established corporate group and enhanced career development opportunities.

The Remuneration Policy has four key principles:

BUSINESS ALIGNMENT

- Focuses on generating rental income and enhancing asset value over time so as to maximise returns from investments and ultimately the distributions and total returns to Unitholders.

- Provides sound and structured funding to ensure affordability and cost-effectiveness in line with performance goals.

- Enhances retention of key talents to build strong organisational capabilities.

- Strengthens alignment to ESG practices.

FAIR & APPROPRIATE

- Ensures competitive remuneration relative to the appropriate external talent markets.

- Manages internal equity such that remuneration is viewed as fair across the CICT Group.

- Puts significant and appropriate portion of payat- risk, taking into account risk policies of the CICT Group, symmetric with risk outcomes and sensitive to risk time horizon.

MOTIVATE RIGHT BEHAVIOUR

- Pay for performance – align, differentiate and balance rewards according to multiple dimensions of performance.

- Strengthens line-of-sight linking rewards and performance.

EFFECTIVE IMPLEMENTATION

- Maintains rigorous corporate governance standards.

- Exercises appropriate flexibility to meet strategic business needs and practical implementation considerations.

- Facilitates employee understanding to maximise the value of the remuneration programmes.

Under the Remuneration Framework, a significant proportion of the KMP's, including the CEO's, total remuneration is in the form of variable compensation, awarded in a combination of short-term, deferred and long-term incentives, to ensure alignment of the CEO's and KMP's interests with those of the Unitholders, with an emphasis on linking pay to business and individual performance. Performance targets are hence set at realistic yet stretched levels each year to motivate a high degree of business performance with emphasis on both shorter-term and longer-term quantifiable objectives. There are four key components of the remuneration for the CEO and KMP:

-

Salary:

Includes the base salary, fixed allowances and compulsory employer contribution to an employee's Central Provident Fund (CPF). The base salary is remunerated based on an employee's competencies, experience, responsibilities and performance. It is typically reviewed on an annual basis to ensure market competitiveness.

-

Performance Bonus:

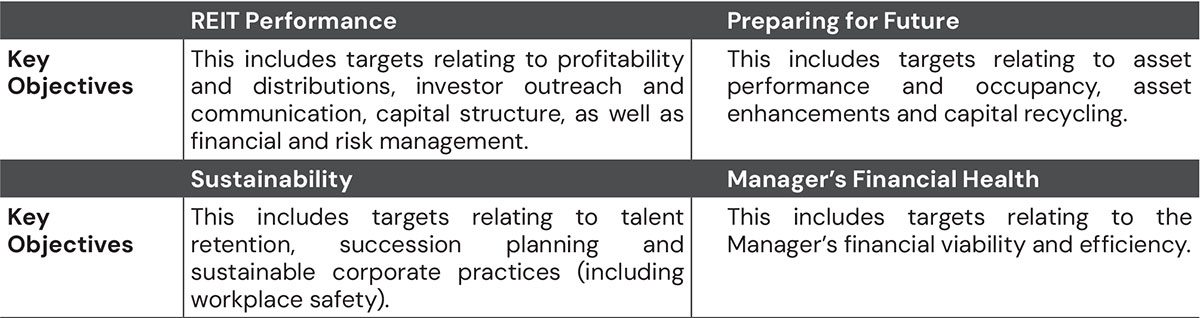

Using the Balanced Scorecard (BSC) framework, the CICT Group's strategies and goals are translated to performance outcomes comprising both quantitative and qualitative targets in the dimensions of REIT Performance, Preparing for Future, Sustainability and Manager's Financial Health. These BSC targets are approved by the Board and cascaded down throughout the organisation, thereby creating alignment across the CICT Group. The performance measures and their relative weights in each dimension are reviewed annually to reflect the CICT Group's business priorities and focus for the relevant year.

After the close of each financial year, the Board reviews the CICT Group's achievements against the BSC targets and determines the overall performance taking into consideration qualitative factors such as the quality of earnings, operating environment, regulatory landscape and industry trends. In determining the Performance Bonus payout quantum for each KMP, the NRC considers the overall business and individual performance as well as the affordability of the payout to the Manager.

The Performance Bonus is paid out in the form of a cash bonus and deferred Units awards with senior management grade employees receiving a greater proportion of their payout in deferred Units. Deferred Units awards are awarded pursuant to the CapitaLand Integrated Commercial Trust Management Limited Restricted Unit Plan (RUP) and vests in three equal annual tranches without further performance conditions. Recipients will receive fully paid Units, their equivalent cash value or combinations thereof. The Units awards ensure ongoing alignment between remuneration and sustainable business performance.

-

Long-Term Incentives:

The Manager has established the CapitaLand Integrated Commercial Trust Management Limited Performance Unit Plan (PUP) and RUP, together the “Unit Plans”, to promote the alignment of Management's interests with that of the Unitholders and CICT's long-term growth and value. The obligation to deliver the Units is satisfied out of existing Units held by the Manager.

The NRC has approved Unit ownership guidelines for senior management to instill stronger identification with the long-term performance and growth of the CICT Group. Under these guidelines, senior management are required to retain a prescribed proportion of Units received under the Unit Plans worth up to at least one year of basic salary. Units vested pursuant to the Unit Plans may be clawed back in circumstances where the relevant participants are found to be involved in financial misstatement, misconduct, fraud or malfeasance to the detriment of the CICT Group.

CapitaLand Integrated Commercial Trust Management Limited Performance Unit Plan

Pursuant to the PUP, Units are awarded to senior management which are conditional on the achievement of targets relating to the following key measurements of wealth creation for Unitholders and commitment of the CICT Group towards sustainability:

- Returns: Relative Total Unitholder Return (TUR) of CICT which is based on the percentile ranking of the TUR of CICT relative to the constituent REITs in the FTSE ST REIT Index;

- Portfolio Growth: Net Asset Value per Unit; and

- Sustainability: Performance outcomes such as green building certification.

The final number of PUP Units to be released will depend on the achievement of pre-determined targets over a three-year qualifying performance period. This serves to align Management's interests with that of Unitholders in the longer term and to deter short-term risk taking. No Unit will be released if the threshold targets are not met at the end of the qualifying performance period. If superior targets are met or exceeded, more Units than the baseline award can be delivered up to a maximum of 200% of the baseline award. The NRC has the discretion to adjust the number of Units released taking into consideration other relevant quantitative and qualitative factors. Recipients will receive fully paid Units, their equivalent cash value or combinations thereof.

For FY 2024, the relevant award for assessment is the performance achieved by the CICT Group for the award granted in FY 2022 where the qualifying performance period was FY 2022 to FY 2024. Based on the NRC's assessment that the performance achieved by the CICT Group has exceeded the pre-determined performance targets for such performance period, the resulting number Units for the finalised award has been adjusted accordingly to reflect the performance level.

In respect of the Units awards granted pursuant to the PUP in FY 2023 and FY 2024, the qualifying performance period has not ended as of the date of this annual report.

In FY 2021, a one-time Special CLI Founders Performance Share Plan (Special PSP Award) was granted by the CLI Group to selected senior executives within the group (including the Manager) to commemorate its listing, foster a “founders' mindset” in driving transformation, and retain talent. The grant has a five-year performance period with defined performance parameters which are linked to CLI. Subject to the performance achieved, the award may vest at the end of the third and/or fifth year.

Such compensation is in the long-term interests of CICT as CICT is a key part of CLI's business and ecosystem (and CLI is also the largest Unitholder of CICT), and Management's actions to grow CICT and drive CICT's performance will also have a positive impact on CLI, thus reinforcing the complementary nature of the linked performance between CICT and CLI. The cost of this one-time award will be borne by the Manager and it is not expected to form a significant part of the KMP's remuneration over a five-year period. In addition, a proportion of the Management's remuneration is paid in the form of Units, which further incentivises the Management to take actions which are beneficial to the Unitholders. Accordingly, the Special PSP Award will not result in the Management prioritising the interest of CLI over that of CICT given that the bulk of their remuneration is determined based on the evaluation of the performance of CICT and a proportion of their remuneration comprises Units. In addition, it should be further noted that under the SFA, the Manager and Directors of the Manager are required to act in the best interest of CICT and give priority to the interest of CICT over the interests of the shareholders of the Manager, and this would further mitigate any potential conflicts of interests. Save for the Special PSP Award, the NRC will continue to assess and reward the KMP based on the performance of CICT. Accordingly, the Manager is of the view that there would not be any conflicts of interest arising from the arrangement, nor would the arrangement result in any misalignment of interest with those of Unitholders.

In respect of the Special PSP Award granted in FY 2021, the performance conditions required for interim vesting in the third year were partially met and CLI shares were released to the participants during the year. The next and final vesting, subject to performance conditions being met, will take place at the end of the qualifying performance period in 2026. There was no new Special PSP Award in FY 2024.

CapitaLand Integrated Commercial Trust Management Limited Restricted Unit Plan

Units awarded pursuant to the RUP may be conditional on pre-determined targets set for a one-year performance period. Prior to FY 2023, these targets were based on: (i) NPI of the CICT Group; and (ii) DPU of the CICT Group. These performance measures were selected as they are the key drivers of business performance and are aligned to Unitholders value.

The final number of Units to be released will depend on the CICT Group's performance against the targets at the end of the one-year qualifying performance period. The Units will be released in equal annual tranches over a vesting period of 3 years. No Units will be released if the threshold targets are not met at the end of the qualifying performance period. If superior targets are met or exceeded, more Units than the RUP baseline award can be delivered, up to a maximum of 150% of the baseline award. The NRC has the discretion to adjust the number of Units released, taking into consideration other relevant quantitative and qualitative factors. Recipients will receive fully paid Units, their equivalent cash value or combinations thereof.

Time-vested awards may also be granted pursuant to the RUP in the form of:

- deferred Units from the Performance Bonus and vest in three equal annual tranches without further performance conditions with the first tranche delivered in the same year as the year of award; or

- time-vested restricted awards for the retention of critical talents, or recruitment of new senior executive hires to compensate for the sharebased incentives that they may have had to forgo when they left their previous employer to join the Manager. Such awards can vest progressively over periods of up to three years, provided recipients of the awards remain under employment of the CLI Group.

As part of the FY 2024 Performance Bonus, deferred Units were awarded in FY 2025 pursuant to the RUP, which will vest in three equal annual tranches without further performance conditions, with the first tranche to be delivered in FY 2025. There were no performance-based and time-vested restricted awards granted pursuant to the RUP in FY 2024.

-

Employee Benefits:

The benefits provided are comparable with local market practices.

Remuneration of Key Management Personnel

Each year, the NRC evaluates the extent to which each of the KMP has delivered on the business and individual goals and objectives, and based on the outcome of the evaluation, approves the remuneration for the KMP. In such evaluation, the NRC considers whether the level of remuneration is appropriate to attract, retain and motivate the KMP to successfully manage CICT for the long term. The CEO does not attend discussions relating to his own performance and remuneration.

In determining the remuneration package for each KMP, the NRC takes into consideration appropriate compensation benchmarks within the industry, so as to ensure that the remuneration packages payable to KMP are competitive and in line with the objectives of the remuneration policies.

While the disclosure of, among others, the names, amounts and breakdown of remuneration of at least the top five KMP (who are not Directors or the CEO) in bands no wider than S$250,000 and the aggregate of the total remuneration paid to these KMP, would be in full compliance with Provision 8.1 of the Code, the Board has considered carefully and decided that such disclosure would not be in the interests of the Manager or Unitholder due to:

- the intense competition for talents in the REIT management industry, the Manager is of the view that it is in the interests of Unitholders not to make such disclosures so as to minimise potential staff movement and undue disruption to its key management team;

- the need to balance the confidential and commercial sensitivities associated with remuneration matters, the Manager is of the view that such disclosures could be prejudicial to the interests of Unitholders;

- the importance of retaining competent and experienced staff to ensure CICT's stability and continuity of business operations, the Manager is of the view that such disclosures may subject the Manager to undue risks, including unnecessary key management turnover; and

- there being no misalignment between the remuneration of the KMP and the interest of Unitholders. Their remuneration is not borne by the REIT as they are paid out from the fees that the Manager receives (the quantum and basis of which have been disclosed in the table below).

The Manager is of the view that disclosure of the total remuneration of the KMP for FY 2024 together with the breakdown of their remuneration in the manner set out in the table below provides a more holistic view and is consistent with the intent of Principle 8 of the Code, and that these and other details in this Report provides sufficient information and transparency to Unitholders on CICT's remuneration policies for KMP, including the level and mix of remuneration and the procedure for setting remuneration. These disclosures would enable Unitholders to understand the relationship between CICT's performance, value creation and the remuneration of KMP. The Manager is of the view that the interests of Unitholders are not prejudiced by the abovementioned deviation from Provision 8.1(b) of the Code, as the remuneration of KMP is aligned to safeguard these interests.

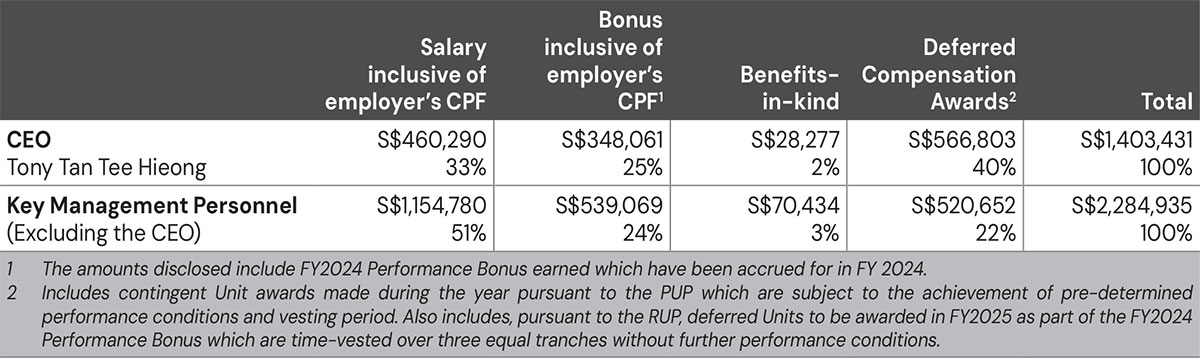

Key Management Personnel Remuneration Table for FY 2024

Apart from the KMP and other employees of the Manager, the Manager outsources various other services to a wholly owned subsidiary of CLI (CLI Subsidiary). The CLI Subsidiary provides these services through its employees and employees of CLI Group (together, the Outsourced Personnel). This arrangement is put in place so as to provide flexibility and maximise efficiency in resource management to match the needs of CICT from time to time, as well as to leverage on economies of scale and tap on the management talent of an established corporate group which can offer enhanced depth and breadth of experience. Notwithstanding the outsourcing arrangement, the responsibility for due diligence, oversight and accountability continues to reside with the Board and Management. In this regard, the remuneration of such Outsourced Personnel, being employees of the CLI Subsidiary and CLI Group, is not included as part of the disclosure of remuneration of the KMP of the Manager in this Report.

In FY 2024, there were no termination, retirement or post-employment benefits granted to Directors, the CEO and other KMP. There was also no special retirement plan, 'golden parachute' or special severance package for any KMP.

There were also no employees of the Manager who were substantial shareholders of the Manager, substantial Unitholders of CICT or immediate family members of a Director, the CEO, any substantial shareholder of the Manager or any substantial Unitholder of CICT. “Immediate family member” refers to the spouse, child, adopted child, stepchild, sibling or parent of the individual.

Disclosures under AIFMR

The Manager is required under the AIFMR to make quantitative disclosures of remuneration. Disclosures are provided in relation to (a) the staff of the Manager; (b) staff who are senior management; and (c) staff who have the ability to materially affect the risk profile of CICT.

All individuals included in the aggregated figures disclosed are rewarded in line with the Manager's remuneration policies described in this Report.

The aggregate amount of remuneration awarded by the Manager to its staff (including CEO and nonexecutive Directors) in respect of FY 2024 was approximately S$7.0 million. This figure comprised fixed pay of S$3.9 million, variable pay of S$2.8 million (including Units issued under the Unit Plans, where applicable) and allowances and benefits-in-kind of S$0.3 million. There was a total of 24 beneficiaries of the remuneration described above. In respect of FY 2024, the aggregate amount of remuneration awarded by the Manager to its senior management (which are also members of staff whose actions have a material impact on the risk profile of CICT) was approximately S$3.7 million, comprising five individuals identified having considered, among others, their roles and decision-making powers.

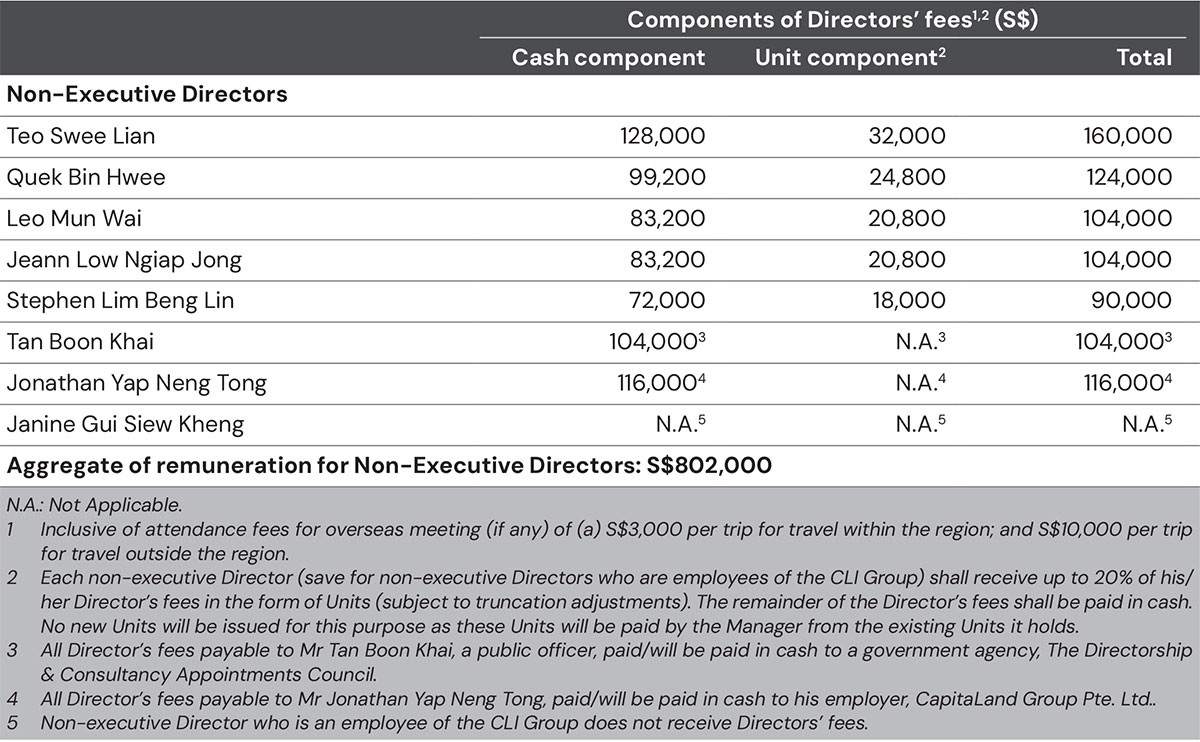

Remuneration for Non-Executive Directors

The non-executive Directors' fees are paid by the Manager and the FY 2024 fees, together with a breakdown of the components, are set out in the Non-Executive Directors' Remuneration Table on page 99 of Annual Report 2024.

The remuneration policy for non-executive Directors is based on a scale of fees divided into basic retainer fees for serving as Director and additional fees for serving on Board Committees. There were no attendance fees payable, save for in-person participation by Directors at Board and Board Committee meetings that require Directors to travel overseas. Directors' fees are paid to nonexecutive Directors on a current year basis.

The CEO, who is an executive director, is remunerated as part of the KMP of the Manager and does not receive any Director's fees for his/her role as an executive director. The non-executive Directors who are employees of the CLI Group also do not receive any Directors' fees.

The non-executive Directors' fee structure and Directors' fees are reviewed and benchmarked against the REIT industry annually, taking into account the effort, time spent and responsibilities on the part of the non-executive Directors in light of the scale, complexity and geographic scope of the CICT Group's business. The remuneration of nonexecutive Directors is reviewed from time to time to ensure that it is appropriate to attract, retain and motivate the non-executive Directors to provide good stewardship of the Manager and CICT. The non-executive Directors' remuneration (including any Unit awards granted under the RUP in lieu of cash) does not include any performance-related elements. The framework for the non-executive Directors' fees has remained unchanged from that of the previous financial year.

The non-executive Directors' fees are paid in cash (about 80%) and in the form of Units (about 20%), save that (i) a non-executive Director (not being an employee of the CLI Group) who steps down from the Board during a financial year will be paid fees fully in cash, and (ii) Mr Jonathan Yap Neng Tong's fees are paid fully in cash to his employing entity, CapitaLand Group Pte. Ltd, and (iii) Mr Tan Boon Khai's fees are paid fully in cash to a government agency, The Directorship & Consultancy Appointments Council. The Manager believes that the payment of a portion of the non-executive Directors' fees in Units will serve to align the interests of non-executive Directors with the interests of Unitholders and CICT's long-term growth and value. The payment of nonexecutive Directors' fees in Units is satisfied from the Units held by the Manager. No individual Director is involved in any decision of the NRC relating to his/her own remuneration.

In order to encourage the alignment of the interests of the non-executive Directors with the interests of Unitholders, a non-executive Director is required to hold a number of Units worth at least one year of the basic retainer fee or the total number of Units awarded, whichever is lower, at all times during his/her Board tenure.

ACCOUNTABILITY AND AUDIT

The Manager maintains adequate and effective systems of risk management and internal controls (including financial, operational, compliance and information technology (IT) controls) to safeguard Unitholders' interests and the CICT Group's assets.

The Board has overall responsibility for the governance of risk and oversees the Manager in the design, implementation and monitoring of the risk management and internal controls systems. The ARC assists the Board in carrying out the Board's responsibility of overseeing CICT's risk management framework and policies for CICT Group.

Under its terms of reference, the scope of the ARC's duties and responsibilities includes:

- making recommendations to the Board on the Risk Appetite Statement (RAS) for CICT Group;

- assessing the adequacy and effectiveness of the risk management and internal controls systems established by the Manager to manage risks;

- overseeing the formulation, updating and maintenance of an adequate and effective risk management framework, policies and strategies for managing risks that are consistent with CICT Group's risk appetite and reports to the Board on its decisions on any material matters concerning the aforementioned;

- making the necessary recommendations to the Board such that an opinion regarding the adequacy and effectiveness of the risk management and internal controls systems can be made by the Board in the annual report for CICT in accordance with the Listing Manual and the Code; and

- considering and advising on risk matters referred to it by the Board or Management, including reviewing and reporting to the Board on any material breaches of the RAS, any material non-compliance with the approved framework and policies and the adequacy of any proposed action.

The Manager adopts an Enterprise Risk Management (ERM) Framework which sets out the required environmental and organisational components for managing risks in an integrated, systematic and consistent manner. The ERM Framework and related policies are reviewed annually.

As part of the ERM Framework, the Manager undertakes and performs a Risk and Control Self-Assessment (RCSA) annually to identify material risks along with their mitigating measures.

The adequacy and effectiveness of the systems of risk management and internal controls are reviewed at least annually, by Management, the ARC and the Board, taking into account the best practices and guidance in the Risk Governance Guidance for Listed Boards issued by the Corporate Governance Council and the Listing Manual.

The ClCT Group's RAS, which incorporates the CICT Group's risk limits, addresses the management of material risks faced by the CICT Group. Alignment of the CICT Group's risk profile to the RAS is achieved through various communication and monitoring mechanisms (including key risk indicators set for Management) put in place across the various functions within the Manager.

More information on the Manager's ERM Framework including the material risks identified can be found in the Risk Management chapter in Annual Report 2024.

The internal and external auditors conduct reviews of the adequacy and effectiveness of the material internal controls (including financial, operational, compliance and IT controls) and risk management systems. This includes testing, where practicable, material internal controls in areas managed by external service providers. Any material non-compliance or lapses in internal controls together with corrective measures recommended by the internal and external auditors are reported to and reviewed by the ARC. The ARC also reviews the adequacy and effectiveness of the measures taken by the Manager on the recommendations made by the internal and external auditors in this respect.

The Board has received assurance from the CEO and the Chief Financial Officer (CFO) of the Manager that the financial records of the CICT Group have been properly maintained and the financial statements for FY 2024 give a true and fair view of the CICT Group's operations and finances. It has also received assurance from the CEO, the CFO and the relevant KMP who have responsibility regarding various aspects of risk management and internal controls that the systems of risk management and internal controls within the CICT Group are adequate and effective to address the risks (including financial, operational, compliance and IT risks) which the Manager considers relevant and material to the current business environment.

The CEO, the CFO and the relevant KMP of the Manager have obtained similar assurances from the respective risk and control owners.

In addition, for FY 2024, the Board received halfyearly certification by Management on the integrity of financial reporting and the Board provided a negative assurance confirmation to Unitholders as required by the Listing Manual.

Based on the ERM Framework established and the reviews conducted by Management and both the internal and external auditors, as well as the assurance from the CEO and the CFO, the Board is of the opinion that the systems of risk management and internal controls within CICT Group are adequate and effective to address the risks (including financial, operational, compliance and IT risks) which CICT Group considers relevant and material to the current business environment as at 31 December 2024. The ARC concurs with the Board in its opinion. No material weaknesses in the systems of risk management and internal controls were identified by the ARC and the Board in the review for FY 2024.

The Board notes that the systems of risk management and internal controls established by the Manager provide reasonable assurance that the CICT Group, as it strives to achieve its business objectives, will not be significantly affected by any event that can be reasonably foreseen or anticipated. However, the Board also notes that no system of risk management and internal controls can provide absolute assurance in this regard, or absolute assurance against poor judgement in decision-making, human error, losses, fraud or other irregularities.

The ARC comprises 4 members, all of whom (including the ARC chairman) are IDs. They bring recent and relevant managerial and professional expertise or experience in accounting, auditing and related financial management domains. The ARC does not comprise former partners of the external auditor, Deloitte & Touche (Deloitte), (a) within a period of 2 years commencing from the date of their ceasing to be partners of Deloitte; or (b) who have any financial interest in Deloitte.

The ARC has explicit authority to investigate matters within its terms of reference. Management gives the fullest co-operation in providing information and resources to the ARC, and carrying out its requests. The ARC has direct access to the internal and external auditors and full discretion to invite any Director or KMP to attend its meetings. Similarly, internal and external auditors have unrestricted access to the ARC.

Under its terms of reference, the ARC's scope of duties and responsibilities includes:

- reviewing the significant financial reporting issues and judgements so as to ensure the integrity of the financial statements of CICT Group and any announcements relating to the CICT Group's financial performance;

- reviewing and reporting to the Board at least annually the adequacy and effectiveness of the Manager's internal controls and risk management systems;

- reviewing the scope and results of the internal audit and external audit, and the adequacy, effectiveness, independence and objectivity of the Manager's internal audit function and the external auditors respectively;

- making recommendations to the Board on the proposals to Unitholders on the appointment, re-appointment and removal of the external auditors, and approving remuneration and terms of engagement of the external auditors;

- reviewing and approving processes to regulate transactions between an interested person (as defined in Chapter 9 of the Listing Manual) and/ or interested party (as defined in the Property Funds Appendix) (each, an Interested Person) and CICT and/or its subsidiaries (Interested Person Transactions), to ensure compliance with the applicable regulations. The regulations include the requirements that Interested Person Transactions (IPTs) are on normal commercial terms and are not prejudicial to CICT's interests and its minority Unitholders. In respect of any property management agreement which is an IPT, the ARC also carries out reviews at appropriate intervals to satisfy itself that the Manager has reviewed the property manager's compliance with the terms of the property management agreement and has taken remedial actions where necessary; and

- reviewing the policy and arrangements for concerns about possible improprieties in financial reporting or other matters to be safely raised, and independently investigated, for appropriate follow up action to be taken.

The ARC also reviews the assurance from the CEO and the CFO on the financial records and financial statements. The ARC reviewed the independence of the external auditors, considering the non-audit services provided, and is satisfied that the independence of the external auditors is not affected by the provision of such services. The external auditors have also provided confirmation of their independence to the ARC. The fees paid or payable to the external auditors for FY 2024 amounted to S$917,287 of which audit (and auditrelated fees) amounted to S$878,287 and non-audit fees amounted to S$39,000.

The ARC met five times in FY 2024. The ARC reviews CICT's half-yearly financial statements, including the relevance and consistency of accounting principles adopted and any significant financial reporting issues, and the quarterly business updates between such announcements, which are presented to the Board for approval.

In FY 2024, the ARC also reviewed and assessed the adequacy and effectiveness of the internal controls and risk management systems established by the Manager to address the material risks faced by the CICT Group, taking into consideration the outcome of reviews conducted by Management and both the internal and external auditors, as well as the assurances from the CEO and the CFO.

The ARC meets internal and external auditors, separately and without Management's presence at least once a year. In FY 2024, the ARC discussed the financial reporting process, internal controls and risk management systems, and significant comments and recommendations by the auditors at the meetings.

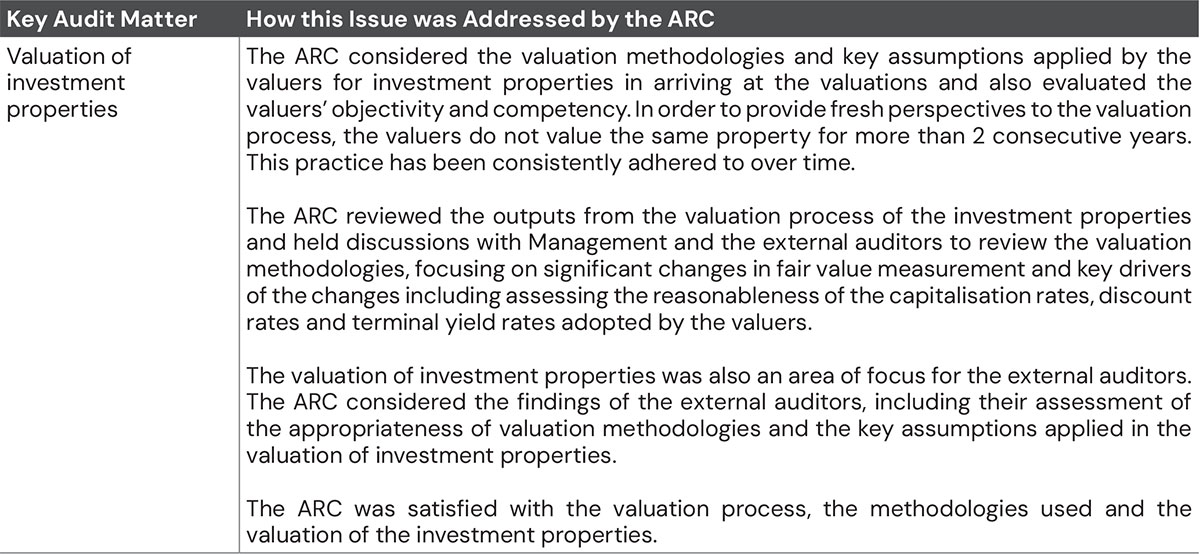

Key Audit Matter

In the review of the CICT Group's financial statements for FY 2024, the ARC discussed with Management the accounting principles applied and their judgement of items that might affect the integrity of the financial statements and also considered the clarity of key disclosures in the financial statements. The ARC reviewed, amongst other matters, the following key audit matter as reported by the external auditors for FY 2024.

The Manager confirms, on behalf of CICT, that CICT complies with Rules 712 and 715 of the Listing Manual in relation to the appointment of its external auditors.

Internal Audit

The Manager has an IA function supported by CLl's Internal Audit Department (CLI IA). The head of CLI IA is Ms Jenny Tan. CLI IA is independent of the activities it audits and has unfettered access to the CICT Group's documents, records, properties and employees, including access to the ARC, and has appropriate standing with respect to the Manager. CLI IA's primary reporting line for CICT Group is the ARC 10.

The ARC monitors and assesses the role and effectiveness of the IA function through the review of IA's processes from time to time. The ARC also reviews to ensure that the IA function is adequately resourced and skilled in line with the nature, size and complexity of the Manager and CICT's business.

In respect of FY 2024, the ARC reviewed the IA function and is satisfied that the internal audit function is adequately resourced, effective and independent. In addition, CLI IA has passed the quality assurance review conducted by an external independent auditor.

CLI IA formulates its internal audit plan in consultation with, but independently of, Management. Its plan is submitted to the ARC for approval prior to the beginning of each year. CLI IA also reviews compliance with the CICT Group's policies, procedures and regulatory responsibilities, performed in the context of financial and operational and information system reviews. CLI IA is guided by the International Standards for the Professional Practice of Internal Auditing (Standards) developed by The Institute of Internal Auditors (IIA), and has incorporated these Standards into its audit practices.

During FY 2024, the ARC reviewed the results of audits performed by CLI IA based on the approved audit plan. All findings are reported to Management and the ARC, with emphasis on any significant findings. CLI IA also reviews the status of implementation of the audit recommendations, and reports the same to Management and the ARC. The ARC reviewed reports on whistleblower complaints reviewed by CLI IA to ensure independent and thorough investigation and adequate follow up. The ARC also received reports on IPTs reviewed by CLI IA that they were on normal commercial terms and are not prejudicial to the interests of CICT and its minority Unitholders.

CLI IA employs suitably qualified professional staff with the requisite skill sets and experience, including IT auditors with the relevant professional IT certifications who are also members of the ISACA Singapore Chapter, a professional body administering information systems audit and information security certifications that is headquartered in the US. CLI IA provides training and development opportunities for its staff to ensure their technical knowledge and skill sets remain current and relevant.

UNITHOLDER RIGHTS AND ENGAGEMENT

The Manager is committed to treating all Unitholders fairly and equitably. All Unitholders enjoy specific rights under the Trust Deed and the relevant laws and regulations. These rights include, among other things, the right to participate in profit distributions.

General Meetings

CICT encourages Unitholder participation and voting at general meetings. Unitholders may download the annual report and notice of the general meeting from the Website and SGXNet. The notice of the general meeting, proxy form and request form for printed annual report/circular are mailed to Unitholders. More than the legally required notice period for general meetings is generally provided. To safeguard the Unitholders' interests and rights, a separate resolution is proposed for each substantially separate matter to be approved at a general meeting, unless the issues are interdependent and linked to form one significant proposal. Where the resolutions are bundled, the reasons and material implications are explained in the notice of general meeting to enable Unitholders to make an informed decision.

In FY 2024, CICT held an annual general meeting (AGM) on 29 April 2024, and an extraordinary general meeting (EGM) on 29 October 2024, by way of physical meetings (collectively, the 2024 General Meetings). In addition, Unitholders were able to attend, participate and vote at the 2024 AGM remotely by pre-registering for and accessing CICT's live webcast or live audio-only stream of the 2024 AGM. Unitholders submitted questions to the chairman of the meeting in advance of the 2024 General Meetings, and substantial and relevant questions received from Unitholders were addressed before the 2024 General Meetings via publication on the Website and SGXNet, or at the meeting. Unitholders could vote at the 2024 General Meetings themselves or through duly appointed proxy(ies). All Directors attended the 2024 General Meetings. The upcoming AGM to be held on 22 April 2025 will be a physical meeting. Further information on the arrangements relating to 2025 AGM is provided in the Notice of AGM.

Unitholders are entitled to attend, participate and vote at general meetings (including through the appointment of proxies or representatives) and communicate their views, ask questions and discuss with the Board and Management on matters affecting CICT. Representatives of the Trustee, Directors (including the chairmen of the Board Committees), KMP and CICT's external auditors, attend to address any queries from Unitholders. Presentation materials for the general meetings are available on the Website and SGXNet.

To ensure transparency in the voting process and better reflect Unitholders' interests, CICT conducts electronic poll voting for all the resolutions proposed at general meetings. One Unit is entitled to one vote. Voting procedures and the rules governing general meetings are explained and votes cast on each resolution, and the respective percentages, are displayed live on-screen at the general meetings. An independent scrutineer is appointed to validate the vote tabulation procedures. The results of the votes cast on the resolutions are announced on SGXNet after the general meetings.

Provision 11.4 of the Code requires an issuer's constitution to allow for absentia voting at general meetings. CICT's Trust Deed currently does not permit Unitholders to vote at general meetings in absentia (such as via mail or email). Further to legislative changes implemented in July 2023 to recognise real-time remote electronic voting, the Manager has implemented relevant amendments to the Trust Deed to permit real-time electronic voting for CICT 11. The Manager is of the view that although this may be considered a partial deviation from Provision 11.4 of the Code as Unitholders or their duly appointed proxy(ies) are still required to attend the general meeting virtually in order to avail themselves of real-time remote electronic voting, Unitholders nevertheless now have greater opportunities (in addition to the proxy regime) to communicate their views on matters affecting CICT even when they are not physically in attendance at general meetings. The Manager will consider amendments to CICT's Trust Deed to permit absentia voting after it has carried out careful study and is satisfied that the integrity of information and the authentication of Unitholders' identities will not be compromised, and after the implementation of legislative changes to recognise methods of voting without the need for Unitholders or their proxy(ies) to be present in-person or virtually. Unitholders can access the minutes of the general meetings on the Website. Accordingly, the rights of the Unitholders are consistent with the intent of Principle 11 of the Code.

Distribution Policy

CICT's distribution policy is to distribute at least 90.0% of its taxable income (other than gains from the sale of real estate properties by CICT which are determined to be trading gains), with the actual level of distribution to be determined at the Manager's discretion. Distributions are generally paid within 35 market days after the relevant record date.

Timely Disclosure of Information

The Manager is committed to keeping all Unitholders, other stakeholders, analysts and the media informed of CICT's performance and any changes in the CICT Group or its business which is likely to materially affect the price or value of the Units, by posting announcements and news releases on SGXNet and the Website in compliance with regulatory reporting requirements, on a timely and consistent basis.

In FY 2024, the Manager provided Unitholders with half-year and full-year financial statements within the relevant periods under the Listing Manual. Such financial statements were reviewed and approved by the Board before being announced on SGXNet and accompanied by news releases. In presenting the financial statements to Unitholders, the Board sought to provide Unitholders with a balanced, clear and comprehensible assessment of CICT and the CICT Group's performance, position and prospects. The Manager provides Unitholders, on a voluntary basis, with quarterly business updates between such announcements, which contain information on the CICT Group's key operating and financial metrics. In addition, the Manager also keeps CICT's Unitholders, stakeholders and analysts informed of the performance and changes in the CICT Group or its business which would likely materially affect the price or value of the Units. The Manager also conducts analysts' and media briefings, and uploads the briefing materials used on SGXNet.

The Manager has a formal policy on corporate disclosure controls and procedures to ensure that CICT complies with its disclosure obligations under the Listing Manual. These controls and procedures incorporate the decision-making process and an obligation on internal reporting of the decisions made.

Investor Relations

The Manager has an Investor Relations department which facilitates effective communication with Unitholders and analysts. The Manager also has a corporate communications function supported by CLl's Group Communications department which works closely with the media and oversees CICT's media communications efforts. The Manager maintains the Website containing information on CICT including its Prospectus, announcements and news releases, financial statements and investor presentations.

The Manager actively engages with Unitholders to solicit and understand their views, and has a Unitholders' Communication and Investor Relations Policy (IR Policy) to promote regular, effective and fair communications with Unitholders. The IR Policy, which sets out the mechanism through which Unitholders may contact the Manager with questions and through which the Manager may respond to such questions, is available on the Website.

Managing Stakeholder Relationships

The Board's role includes considering sustainability as part of its strategy formulation. The Manager adopts an inclusive approach for CICT by considering and balancing the needs and interests of material stakeholders. The Manager is committed to sustainability and incorporates the key principles of environmental and social responsibility, and corporate governance in CICT's business strategies and operations. The Manager has arrangements to identify, engage and manage relationships with material stakeholder groups from time to time, and gathers feedback on the sustainability issues most important to them. The Manager also updates the Website with current information on its sustainability approach and stakeholder engagements, to facilitate communication and engagement with CICT's stakeholders.

The rights of CICT's creditors, which comprises of lending banks, are protected with a well-spread debt maturity, healthy interest coverage ratio and gearing ratio below the regulated limit. Regular internal reviews are also conducted to ensure that various capital management metrics remain compliant with loan covenants.

ADDITIONAL INFORMATION

The Board has also established an EC, which oversees the day-to-day activities of the Manager and CICT. The EC is guided by its terms of reference, in particular, the EC approves specific budgets for capital expenditure on development projects, acquisitions and enhancements/upgrading of properties within its approved financial limits; reviews management reports and operating budgets; and awards contracts for development projects. The members of the EC also meet informally during the year.

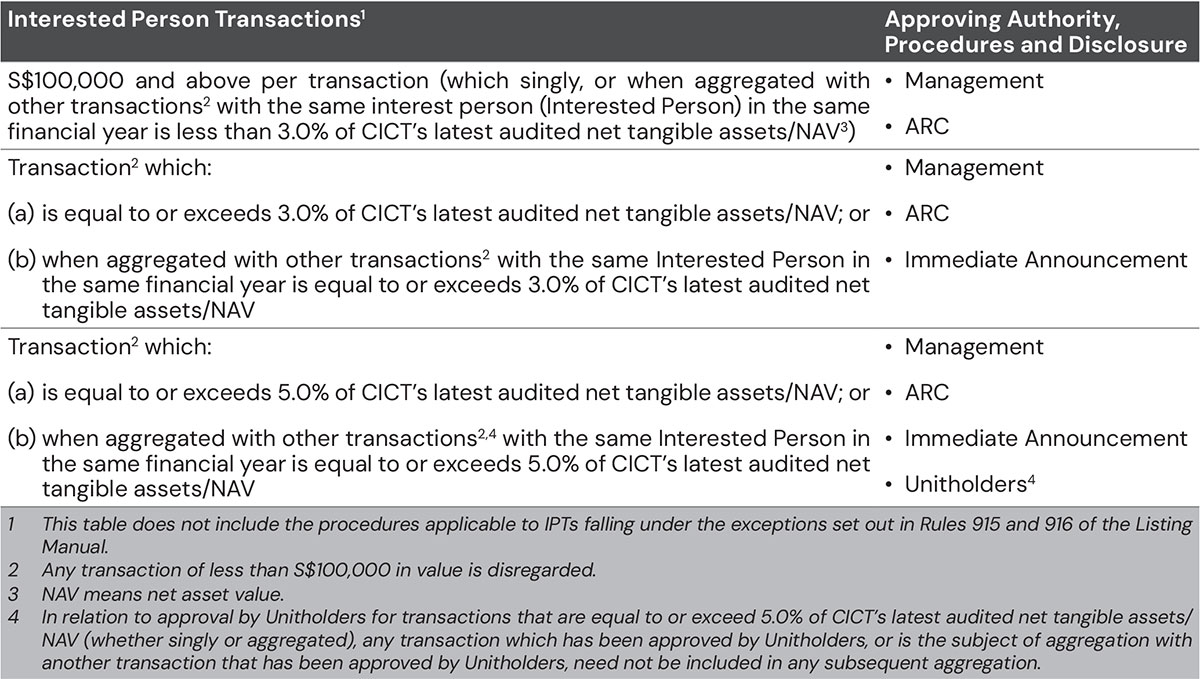

Review Procedures for Interested Person Transactions