Portfolio Overview

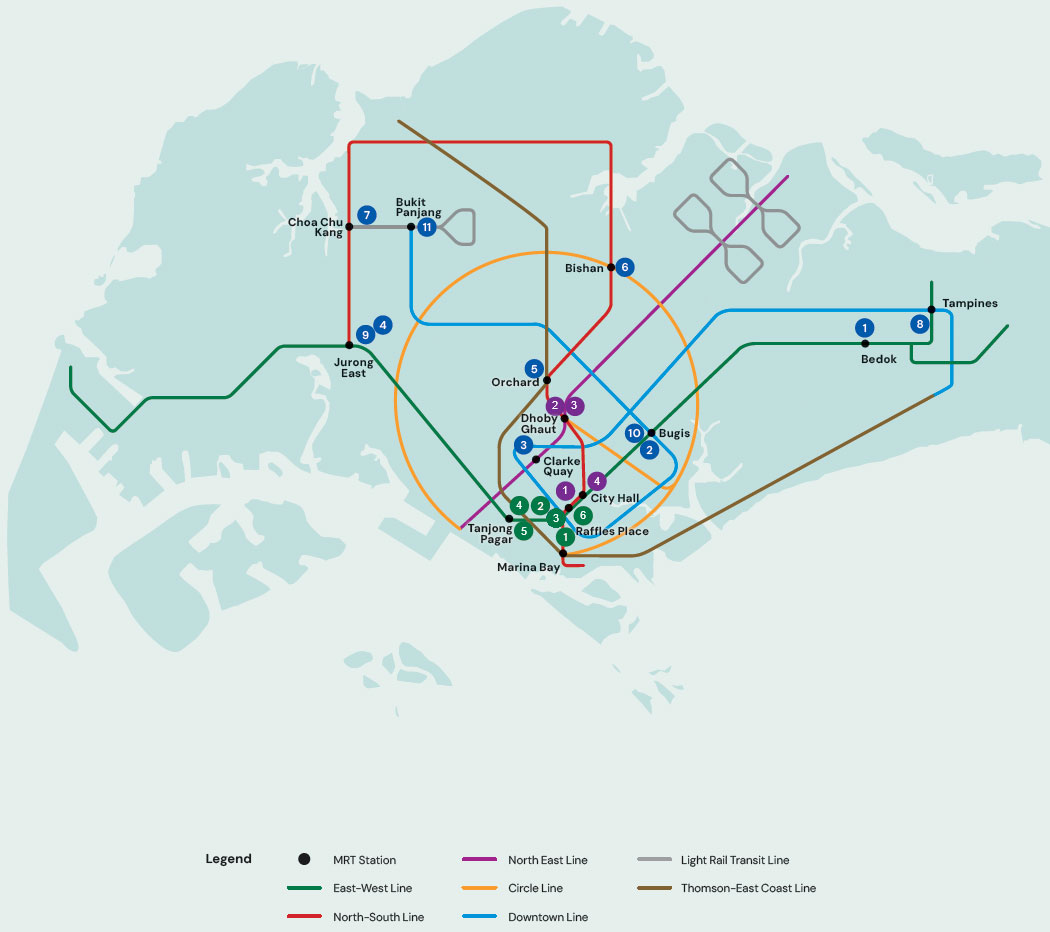

Singapore

Retail

Office

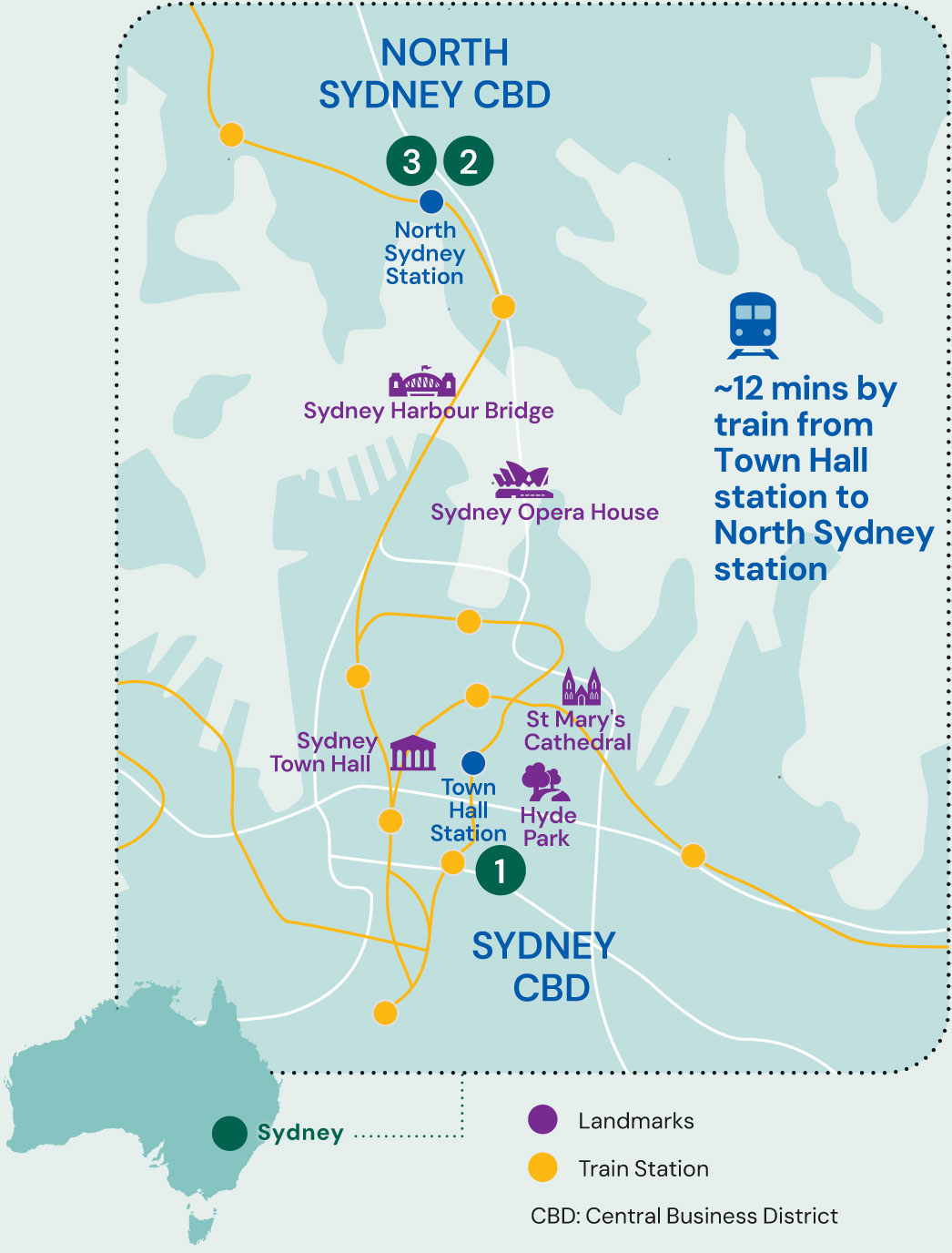

Sydney, Australia

Sydney, Australia

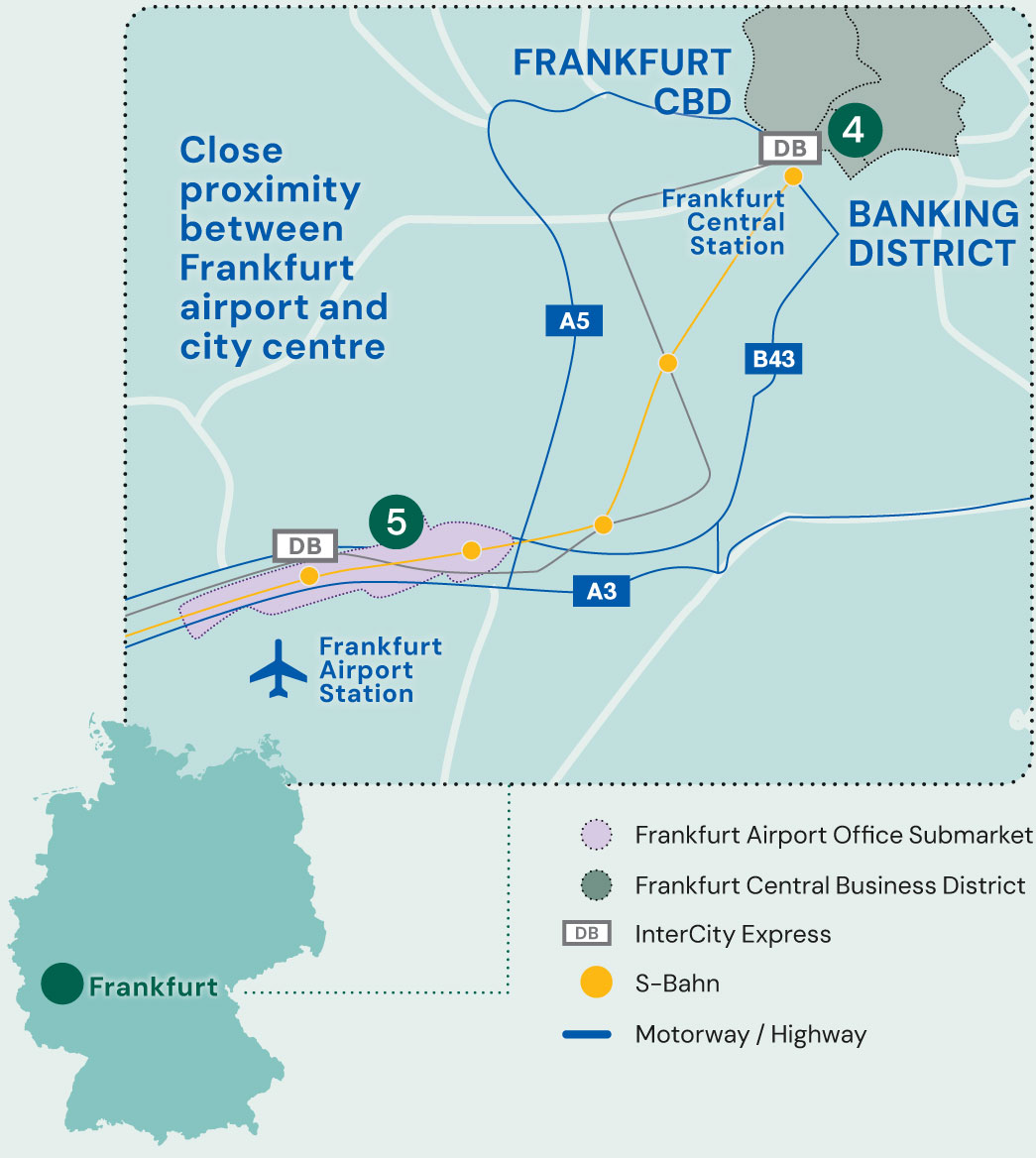

Frankfurt, Germany